How Local Businesses Can Adapt to Economic Shifts Through Practical Strategy and Community-Centered Action

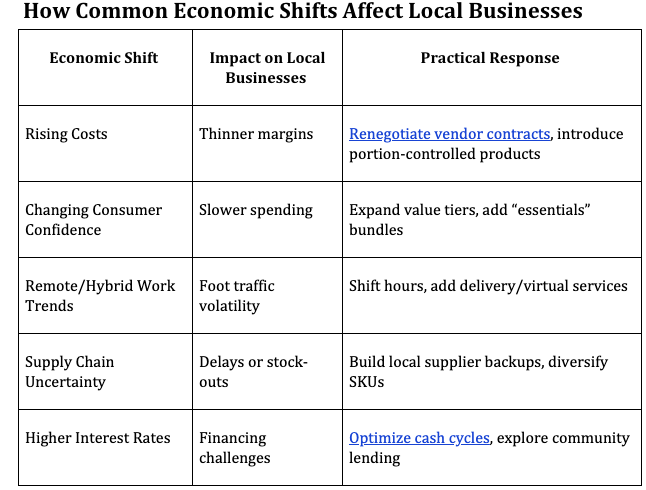

Local businesses from neighborhood cafés to service firms sit at the front line of economic fluctuation. When markets tighten or spending patterns shift, the ripple effects show up fast: slower foot traffic, cautious customers, higher operating costs. But the most resilient local companies share a common trait: they treat change as a design constraint, not a threat.

Key Takeaways

Local businesses can stay resilient by adapting offerings quickly, tightening financial discipline, and leaning on community partnerships. Small operational shifts, faster feedback loops, and smart collaboration often protect cash flow and strengthen customer loyalty during economic uncertainty.

Staying Nimble: The Hidden Strength of Successful Local Businesses

Economic shifts rarely announce themselves neatly. Inflation spikes, interest rates rise, people travel less, or remote work reshapes buying behavior. Local businesses thrive when they:

Detect changes in customer expectations quickly

Reposition offerings before demand forces it

Adjust cost structures without eroding quality

Reinforce their identity in the community ecosystem

This combination of clarity, adaptability, and domain awareness lets businesses continue operating from a position of strength rather than reacting in panic.

Strength in Community: The Power of Local Networks

One of the biggest advantages small businesses have over large organizations is proximity literal and emotional to their customers. Economic pressure tends to heighten the value of shared identity. Owners who show up in community-centered ways often see higher repeat business:

Co-host pop-ups with nearby shops

Collaborate with neighborhood associations

Create “locals-only” loyalty perks

Partner with community colleges or chambers for hiring pipelines

When budgets shrink, consumers choose relationships—and memory—over convenience.

How to Strengthen Your Business Against Market Swings

Inventory Efficiency: Audit slow-moving items monthly, not quarterly.

Pricing Hygiene: Refresh pricing tiers every 90 days based on costs.

Demand Feedback Loop: Ask five customers each week, “What would keep you coming back more often?”

Cash Flow Discipline: Track payables/receivables weekly.

Local Partnerships: Add two new collaborations each quarter.

Digital Basics: Keep hours, menus, pricing, and holiday schedules updated across Google, Maps, and social profiles.

Staff Cross-Training: Teach one additional skill per employee per quarter.

Service Extensions: Identify one offering that could be turned into a subscription or recurring service.

How Education Strengthens Business Agility

As markets evolve, some owners lean on additional training to make smarter operational and financial decisions. Leaders who understand budgeting, forecasting, organizational strategy, and operational efficiency can adapt faster because they know how to read patterns before they become problems. Some try pursuing short workshops or choosing a business administration program to strengthen long-term decision-making. Online degree programs can help owners expand their strategic toolkit and better interpret the signals that drive local market behavior.

Immediate Actions That Boost Resilience

These operational moves can create immediate stability:

Introduce “theme weeks” or rotating product features to test new offerings without committing.

Negotiate shared delivery drivers with nearby shops to cut transportation expenses.

Add pre-order or bulk-purchase incentives to secure early cash flow.

Offer micro-memberships—low-cost monthly perks that create predictable income.

Repackage existing services into higher-value bundles (e.g., seasonal care kits, curated boxes, VIP maintenance plans).

Creating Community Alliances

Identify Local Needs

Spend one hour observing customer patterns—what they ask for, when traffic peaks, where confusion occurs.Map Shared Interests

Look for other businesses or organizations serving the same audience: gyms, childcare centers, clinics, artisan shops, nonprofit groups.Design a Mutual-Benefit Collaboration

Examples: joint promotions, bundled services, referral exchanges, co-funded events, shared pop-up spaces.Launch a 30-Day Pilot

Commit to testing one collaboration for a month with clear success metrics (traffic lift, email signups, cross-referrals).Evaluate & Expand

Tighten what works, drop what doesn’t, and rotate in new partners every quarter.

FAQs

Q: How often should a small business adjust pricing during economic turbulence?

A: Every 60–90 days. Costs change quickly, and outdated pricing is a silent margin killer.

Q: What’s the simplest way to increase loyalty without discounting?

A: Add service-based perks priority service, early access, or members-only events.

Q: How do I know which products to cut during downturns?

A: Look at contribution margin, not popularity. A popular but low-margin item drains cash.

Q: Is now a good time to expand?

A: Sometimes if expansion aligns with proven demand and a low-risk pilot. Test before you commit.

Conclusion

Local businesses can’t eliminate economic turbulence, but they can blunt its impact through smart planning, community alliances, and operational agility. When owners stay close to customer behavior and keep their operating model flexible, they often emerge stronger than before. The most resilient companies aren’t the biggest they’re the ones that adapt early, act intentionally, and invest in understanding the forces shaping their market.